Are you really making any money? What part of your business is most profitable? How do you handle depreciation? Do you have enough cash flow to support your growth? How do you compare to others in the industry? When can you afford new people and equipment as you grow?

If you cannot answer these questions, not to mention many others, it means you are either not getting good, management-oriented financial information or you do not understand what you are or should be getting.

The plain truth is that many business owners do not understand their financials. They simply started their business, bought off-the-shelf software for an accounting system, and implemented the simplified Chart of Account included with it. Their CPA does the annual tax return and prepares a Profit & Loss Statement and a Balance Sheet for their position at the end of the year. Their software printouts give them an up-todate status anytime they want to print it out. This is all they need, right? Wrong.

The Bare Minimum

Successful owners understand their financials and know how to use them in planning and guiding their businesses into the future. Your financials consist of:

- Profit & Loss Statement

- Balance Sheet

- Statement of Cash Flows

- Budgets (Short and Long Range)

- Cash Flow Projections

- Operating Ratios

- Job Costing

- Bidding and Pricing Computations

Knowledgeable owners understand and work with these documents on a regular basis, understand that they are all related to one another, and use them daily to steer their businesses. This is the minimum information you need to manage your business.

Why do you need to understand them? You need to understand them to successfully guide and develop your business. The first time you approach a bank or bonding company, or ask for significant vendor credit, these people will ask you for your financials. They will analyze them and give you a response. It is important for you to understand your financials at the same level as their analysis so you will anticipate and understand the response you get.

Many contractors think that the Profit & Loss and Balance Sheet Statements included in their CPA-prepared tax returns at the end of the year are adequate financials. Nothing could be further from the truth. These statements are prepared to minimize or defer the income taxes you have to pay. They give you little in the way of useful management information. They tell you what happened in the past, but say nothing about what is happening now, or what should or will happen in the future.

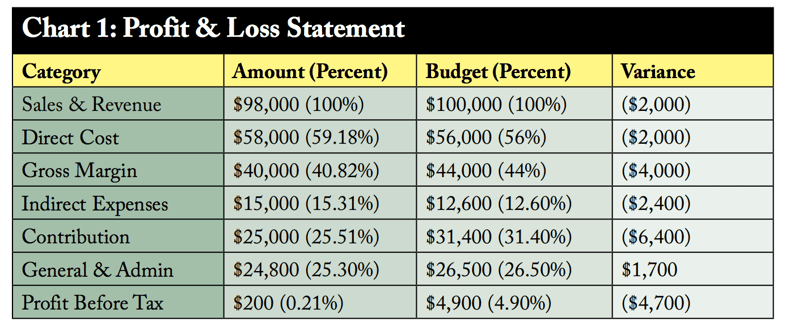

Look briefly at an abbreviated Profit & Loss Statement (Chart 1).

Wow… you made $200… at least you were profitable. Yes you were, but you had planned to make $4,900—and that’s a lot more profitable. What went wrong?

Now suppose you had all the subcategory line items filled in with data, and your budgets and reports were broken down by each department or service line you have. You would really have some valuable information for deciding where your costs were out of line and where you should direct your efforts toward improvement. Do your financials give you the information shown above? They should.

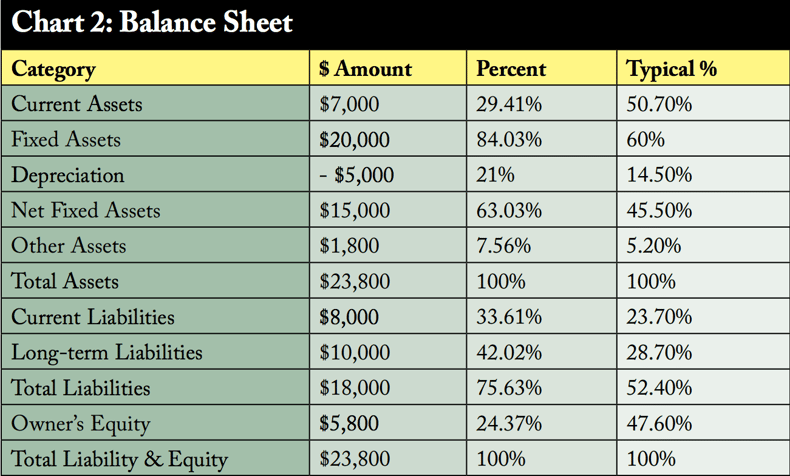

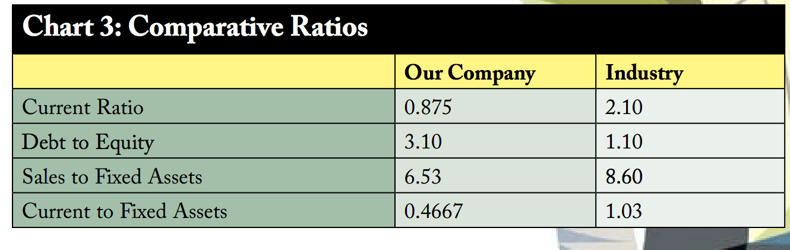

Now let’s look briefly at the Balance Sheet for the company (Chart 2). Then look at a few comparative ratios (Chart 3).

Facing the Facts

Looking at the financial numbers in the charts, we should be able to get some insights about our low profitability relative to industry norms.

Failure to keep expenses on budget. From the Profit & Loss Statement, we noticed that our Gross Margin is low (40.8% vs. 44.0%) and our Contribution Margin is low (25.5% vs. 31.4%). Our General & Administrative Expense is close to being OK, so our main problem lies in expense control vs. our budget.

Inadequate return on equipment investment. Looking at the Balance Sheet data and ratios we have computed, we note that we are definitely Fixed Asset-heavy. Our Fixed Asset ratio is 84% vs. 60% norm, and Net Fixed Assets are heavy at 63% vs. 45.5%. Financing this equipment has left us with both high Current Liabilities (33.6% vs. 23.7%) and high Long-term Liabilities (42% vs. 28.7%).

Unfortunately, our heavy investment in equipment has not converted into increases in efficiency or field operations like we thought it would when we developed our budget. We either need better training on how to use the equipment, or must admit that we love our iron too much and we just have too much of it.

Low profits and high debt. Our low Current Assets ratio of 29.4% vs. 50.7% indicates that lack of profitability and high debt burden have limited our ability to build up the Working Capital we need to support our business without turning outside to borrow more debt.

Is the bank likely to float us a big loan right now to get through the next season? That’s not likely because our Debt-to-Equity ratio is at 3.10, which is at the upper limit most banks would be willing to accept. Banks prefer a 1.0 ratio and will usually go to 2.0 if they think we know what we are doing. Unfortunately our P&L—and our ability to hit budget—doesn’t indicate that we know what we are doing.

Survival of the Fittest

What should we do to survive? First of all, dump the big equipment. Would a small walk-behind digger work as well (if not better) than the skid steer or the backhoe rusting away out in the yard? Would a 42-inch zero-turn be more efficient than the 16-foot batwing mower we thought we needed? We need to reduce our debt burden substantially so the bank likes us again. It looks like we might want to focus on training our field personnel better with the smaller equipment and work on improving efficiency to improve our direct costs.

It’s hard to draw much more out of the data I presented at this highly summarized level. More detailed analysis could come from the full detail statements we should be receiving. It is amazing, though, that we were able to reach some major directional decisions with just this scant information.

That is the point of this article. You can’t run your business and guide it properly without a good understanding of the financials that underlie it. In the case presented here, I would recommend that additional training isn’t just necessary for the field troops. We could use a little financial management training in the “Head Shed” too.

By Rod Bailey, CCLP, a green industry consultant and veteran landscape contractor with more than 40 years of experience in the industry. He specializes in f inancial management and strategic planning, and can be reached at rodbailey@hotmail.com or by calling (206) 612-2704.

Site Search

Site Search